Impact of Regional Electricity Pricing and Strategic Implications for Gyeonggi Province

A fact-based summary of why regional electricity pricing is being discussed in Korea and how it affects Gyeonggi Province.

⚡ Why Regional Electricity Pricing Is Being Discussed

Korea’s structural supply-demand imbalance is driving policy change.

According to the report, Korea’s electricity system faces a persistent mismatch between where electricity is consumed and where it is generated.

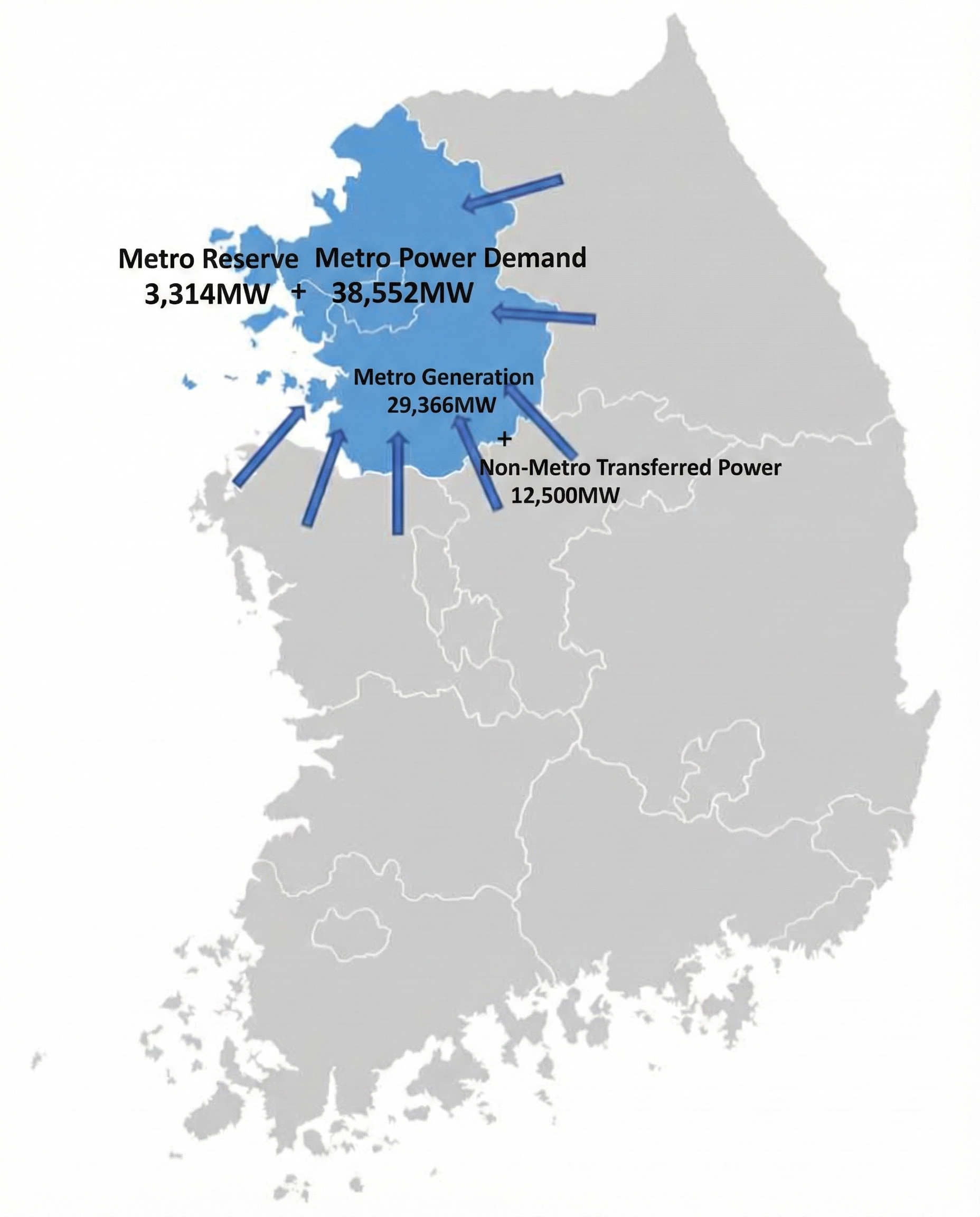

✔ Heavy demand concentration in the metropolitan area

- In 2023, the Seoul–Gyeonggi–Incheon region accounted for 41.2% of Korea’s peak demand (38,522 MW out of 93,615 MW).

- To meet this demand, 12,500 MW was imported from non-metropolitan regions.

✔ Demand in Gyeonggi Province will keep rising

- By 2029, 601 out of 732 new data centers (82%) will be located in the metropolitan area.

- These data centers are expected to consume 39,802 MW of electricity by 2029 (80.6% of national data center load).

- The Yongin semiconductor cluster alone may require up to 16 GW of additional supply through 2053.

✔ Meanwhile, generation continues to concentrate outside the metropolitan area

- From 2014 to 2024, the generation share outside the metro region increased from 71.89% to 74.23%,

while the metropolitan share fell from 28.11% to 25.77%.

This structural imbalance places heavy pressure on transmission lines.

⚠️ Transmission Congestion Is Reaching Its Limit

- The metropolitan area is supplied by seven major transmission corridors.

- Their allowable transfer capability (voltage-stability limit) is 10,900–12,600 MW.

- On May 31, 2023 at 12:00, the imported power reached 11,058 MW,

or 99.62% of the upper limit.

At the same time, new transmission construction faces public resistance:

- The Hanam HVDC converter station project was rejected due to insufficient community acceptance.

- Several 345 kV and HVDC projects have been delayed 66 to 150 months beyond schedule.

Transmission expansion is no longer a reliable solution.

📜 Policy Background: Legal Basis for Regional Pricing

- The Special Act on Distributed Energy (2024) allows electricity tariffs to differ by region,

considering transmission and distribution costs.

Government direction:

- 2025 (first half): Regional differentiation in the wholesale market

- 2026 and beyond: Potential introduction of regional retail tariffs

KPX’s proposed market structure:

- Short-term: Zonal pricing (Metropolitan / Non-metropolitan / Jeju)

- Long-term: Nodal pricing at the bus level

🧠 How the Report Conducts Its Analysis

Our study uses:

- The KPG193 synthetic Korean power system (193 buses, 123 generators, 407 lines)

- Hour-by-hour demand and renewable data from 2022

🧪 Market Models Used in the Report (M1–M4)

Our study evaluates four different electricity market designs, ranging from a simple single-price system to a full nodal pricing system.

These models determine how regional electricity prices are calculated and how transmission congestion is reflected.

| Model | Description | Key Characteristics |

|---|---|---|

| M1 — Single Price Market | One uniform SMP nationwide |

• No congestion modeling • No loss modeling • Simplest baseline market |

| M2 — SCED-Based SMP | SCED with a single SMP |

• Congestion handled via redispatch • SMP remains a single national price • More realistic than M1 |

| M3-1 — Zonal SMP | Two SMP zones |

• Metropolitan vs Non-metropolitan prices • Reflects regional imbalance • Still uses SMP per zone |

| M3-2 — Zonal LMP (Load-Weighted) | Load-weighted LMP for each zone |

• Uses zonal marginal price • Congestion partially reflected • Metro price slightly lower than M2 |

| M4 — Nodal Pricing (LMP) | Bus-level marginal pricing |

• Fully models congestion & losses • Each bus has its own price • Industrial clusters may face 34–36% price increases under load growth |

📈 Key Findings (Strictly from the Report)

1️⃣ Metropolitan wholesale prices barely change

Across scenarios:

- Metropolitan prices remain similar to the current SCED-based market (M2).

- A slight decrease appears only in M3-2 and M4.

2️⃣ Non-metropolitan prices fall sharply (~40%)

The result explicitly states:

“Non-metropolitan market prices decrease by approximately 40%.”

This creates major revenue impacts for non-metropolitan generators.

3️⃣ Relative profitability shifts toward Gyeonggi Province

- Non-metropolitan generators see significant revenue reductions.

- Metropolitan regions (including Gyeonggi) see little change, creating a relative advantage.

4️⃣ Retail tariffs: Gyeonggi consumers may feel disadvantaged

If retail tariffs follow wholesale prices:

- Non-metropolitan retail tariffs fall significantly.

- Metropolitan tariffs remain similar.

- This produces risk of perceived unfairness among metropolitan consumers.

5️⃣ Renewable investment potential in Gyeonggi remains limited

- High land costs result in poor economic feasibility for most ground-mounted solar projects.

- However, rooftop PV (LCOE ~ 96원/kWh) is economically viable across all cities in Gyeonggi Province.

6️⃣ Industrial clusters face steep price increases in nodal pricing

When industrial load increases by 3 GW in scenario M4:

- Yongin semiconductor cluster experiences 34% higher LMP (average scenario).

- Paju LCD complex shows up to 36% increase (autumn-night scenario).

Industrial zones without nearby generation resources are especially vulnerable.

🧭 Strategic Recommendations in the Report

✔ 1. Develop new generation capacity near congestion-prone areas in Gyeonggi

To prevent steep LMP increases when local loads grow.

✔ 2. Prioritize rooftop solar as the main renewable strategy

The only renewable option with strong economic feasibility across all cities.

✔ 3. Prepare policies to mitigate “consumer dissatisfaction”

Metropolitan retail prices may remain higher than non-metropolitan regions.

✔ 4. Manage risks in fast-growing industrial regions (Yongin, Paju)

Where future nodal prices may spike due to limited local generation.

📘 References

Kim, Jip, et al. “지역별 전기요금 차등제 도입 영향 및 경기도 대응 방안 (Impact of Introducing Regional Electricity Pricing and Strategic Responses for Gyeonggi Province)”. Gyeonggi Research Institute, 2025.[link]