Causality-Based Cost Allocation for Peer-to-Peer Energy Trading

A clear explanation of how causality-based pricing makes P2P trading fairer and more grid-friendly in distribution systems.

🤝 Making P2P Energy Trading Fair and Grid-Friendly

Figure 1. Peer-to-peer energy trading. (Image source: Pulse Energy; modified by Gemini)

Peer-to-peer (P2P) energy trading lets small consumers and generators exchange electricity directly.

It promotes community energy use and renewable adoption — but it also interacts with the physical grid.

The problem?

Some trades stress the grid far more than others — but current pricing treats everyone the same.

This can cause:

- voltage violations

- line congestion

- increased system losses

- unfair cost allocation

This work introduces a causality-based cost allocation method that charges peers based on the actual impact their trades impose on the distribution network.

⚡ Why Existing Approaches Fall Short

1) Universal cost allocation

Everyone pays the same network fee per MWh.

Issue:

Harmless peers subsidize harmful ones → inefficient and unfair.

2) Distance or zone-based fees

Uses electrical distance or zone grouping.

Issue:

Distance ≠ true physical impact. Not aligned with real-time grid behavior.

3) Hard constraints

Block trades that violate limits.

Issue:

Too restrictive. Prevents beneficial trades and lowers total welfare.

🧠 Key Idea: Charge Peers According to Causality

Instead of spreading costs evenly, the proposed method:

- Observes each peer’s trade.

- Measures how much that specific trade changes:

- system losses

- line flows

- voltage levels

- Charges cost only to the peers who caused those changes.

- Peers adjust their trading decisions accordingly.

Result:

Grid-friendly trades are encouraged; harmful trades become more expensive.

No banning trades. No punishing everyone.

Just meaningful, physics-based price signals.

What “causality” means here:

the network charge is based on the marginal physical impact of each peer’s net injection or withdrawal on losses, voltages, and line loading — not on distance, zones, or averaging.

Practically, this impact is computed using power-flow sensitivities, i.e., how a small change in a peer’s net trade affects the grid around the current operating point.

🗺 Test System: IEEE 33-Bus Distribution Feeder

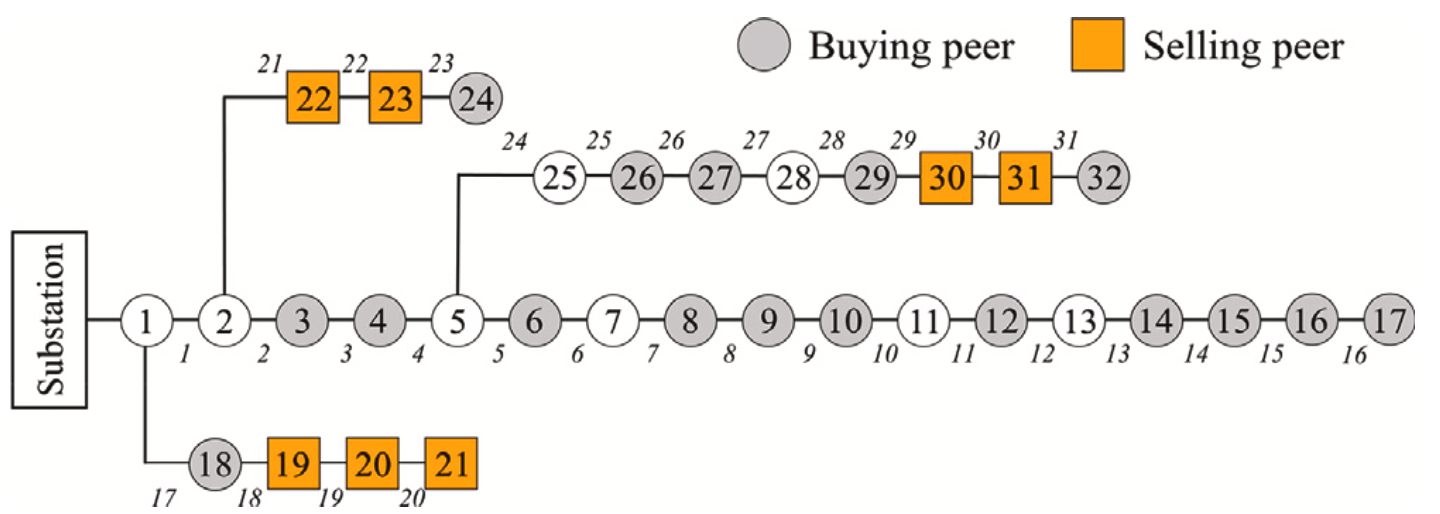

Figure 2. Test feeder with 7 sellers and 17 buyers spread across the network.

This radial feeder highlights classic distribution-level challenges:

- weak voltages

- long feeders

- congestion near the substation

📊 Scenario 1 — Only Loss Cost Considered

| Policy | Social Welfare | System Loss | Trading Volume |

|---|---|---|---|

| Base | 581.25 | 0.39 | 4.67 |

| Universal | 580.60 | 0.36 | 4.50 |

| Causality-Based | 592.59 | 0.28 | 4.53 |

What this means:

- Universal policy lowers everyone’s trades → welfare barely improves.

- Causality-based charges reduce loss-causing trades only.

- Total system loss down 22.8%, welfare up highest of all policies.

📈 Scenario 2 — Voltage, Congestion, and Loss

| Policy | Voltage Security | Trading Volume | Social Welfare |

|---|---|---|---|

| Base | Violations | 4.67 | 581.25 |

| Universal | Secure (over-conservative) | 1.76 | 351.14 |

| Causality-Based | Secure & efficient | 2.97 | 498.35 |

Interpretation:

- Universal overreacts → everyone trades less → grid underutilized.

- This happens because a uniform fee penalizes all trades equally, even those that barely affect the binding constraints.

- Causality-based pricing identifies who causes violations:

- High-impact peers reduce trades.

- Low-impact peers trade more.

- Grid becomes secure without sacrificing welfare.

🔧 Example: Who Actually Pays More?

Intuition example (one line bottleneck):

If a line is close to its limit, a peer located electrically “behind” that line can noticeably increase line loading with additional trading — and therefore pays a higher congestion-related charge.

Meanwhile, a peer whose trade mostly circulates locally (small change in voltages and flows) pays close to zero, even if the traded energy (MWh) is similar.

This is true cost causation, not approximation.

💡 Why This Matters

✔ Fair

Peers pay based on actual impact, not arbitrary fees.

✔ Efficient

Trading adjusts intelligently rather than uniformly shrinking.

✔ Improves social welfare

Because good trades are encouraged while harmful ones diminish.

✔ Maintains grid security

Voltage & congestion remain within limits — without banning trades.

✔ Better than universal cost allocation

Universal is simple but inefficient; causality-based is both principled and practical.

📘 Reference

Kim, H. J., Song, Y. H., & Kim, J. “Causality-based cost allocation for peer-to-peer energy trading in distribution system.” Electric Power Systems Research, 2024.

[link]