Risk-Aware Bidding for VPPs with Power-to-Hydrogen

How hydrogen storage helps virtual power plants bid more strategically and manage market risk under renewable uncertainty.

🔋 Risk-Aware Bidding for VPPs with Power-to-Hydrogen

A clear and intuitive explanation of how hydrogen improves VPP bidding.

Figure 1. VPP can reduce congestion and redirect flows more efficiently.(Image source: Toshiba)

Virtual Power Plants (VPPs) bring together distributed resources—such as solar, wind, batteries, and now hydrogen systems—to operate like a flexible power plant in electricity markets.

But there’s a challenge:

Electricity markets are volatile, and renewable output is uncertain.

A poor bidding strategy can lead to major financial losses.

This post explains how Power-to-Hydrogen (P2H) and risk-aware optimization help VPPs make smarter bidding decisions.

⚡ Why Bidding Is Hard for VPPs

VPP operators must decide how much energy to bid into the market ahead of time.

However:

- Solar and wind output fluctuate

- Prices move unpredictably

- Overbidding can cause penalties

- Underbidding loses opportunities

Most VPPs rely on batteries (ESS) to buffer uncertainty, but batteries alone are often not enough.

This is where hydrogen enters the picture.

🔋 Why Hydrogen Helps VPPs

A Power-to-Hydrogen system includes:

- Electrolyzer → converts electricity into hydrogen

- Hydrogen tank → stores hydrogen for long periods

- Fuel cell → converts hydrogen back to electricity

Compared to batteries, hydrogen offers:

- Much larger storage capacity

- Ability to charge and discharge simultaneously

- Better economic potential as hydrogen prices drop

- Flexibility for multi-energy markets (electricity + hydrogen)

Hydrogen essentially acts as a deep buffer that smooths uncertainty.

📉 The Risk Issue: Market Volatility

Even with hydrogen, the VPP faces financial risk:

- Low renewable output → must buy expensive electricity

- High renewable output → prices may drop unexpectedly

- Extreme scenarios (tail events) → major losses

To protect against these risks, we use CVaR (Conditional Value-at-Risk) — a common tool in finance for controlling downside risk.

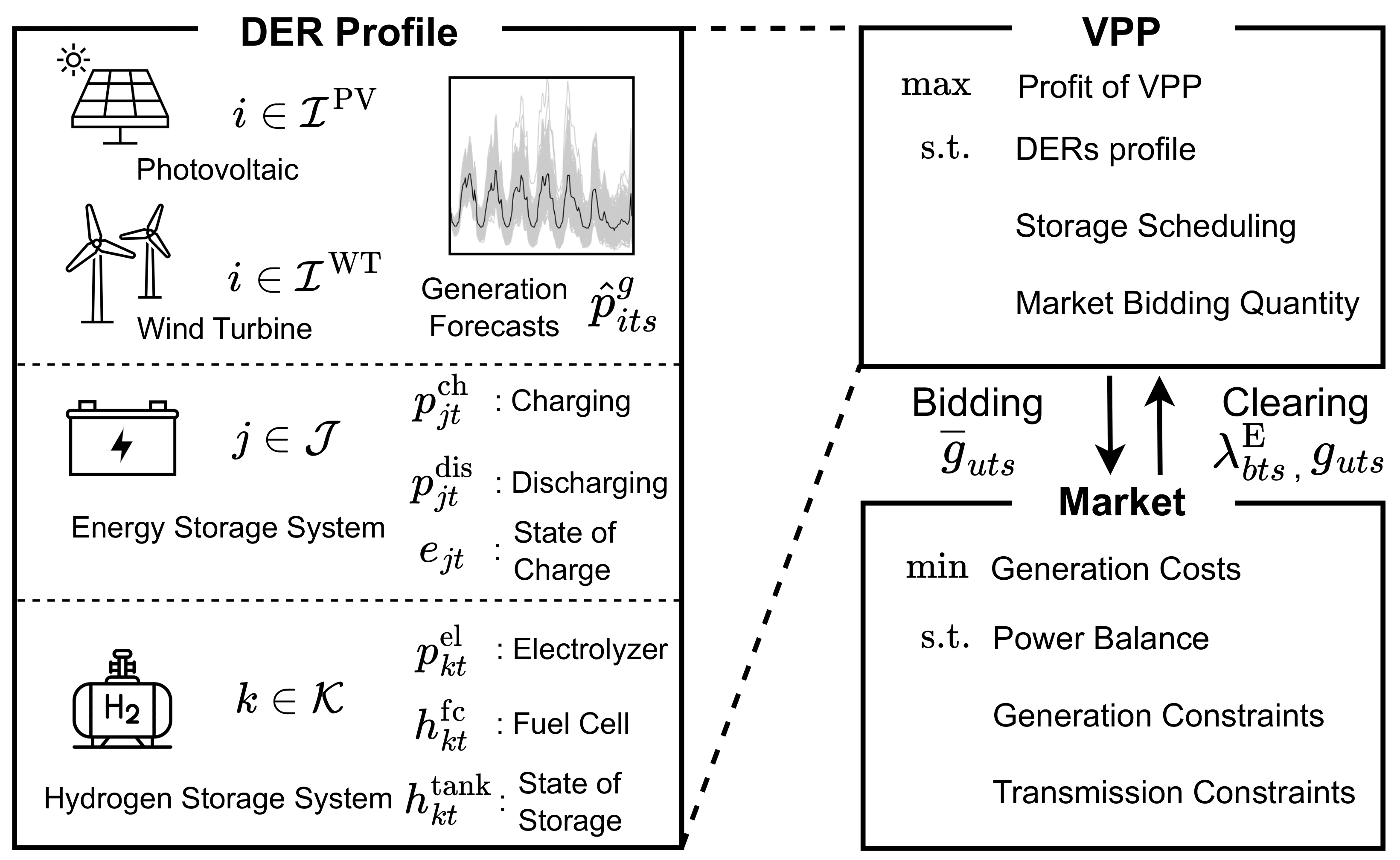

🧠 The Proposed Approach: A Risk-Aware Bi-Level Model

In this regard, we introduces a bi-level optimization structure:

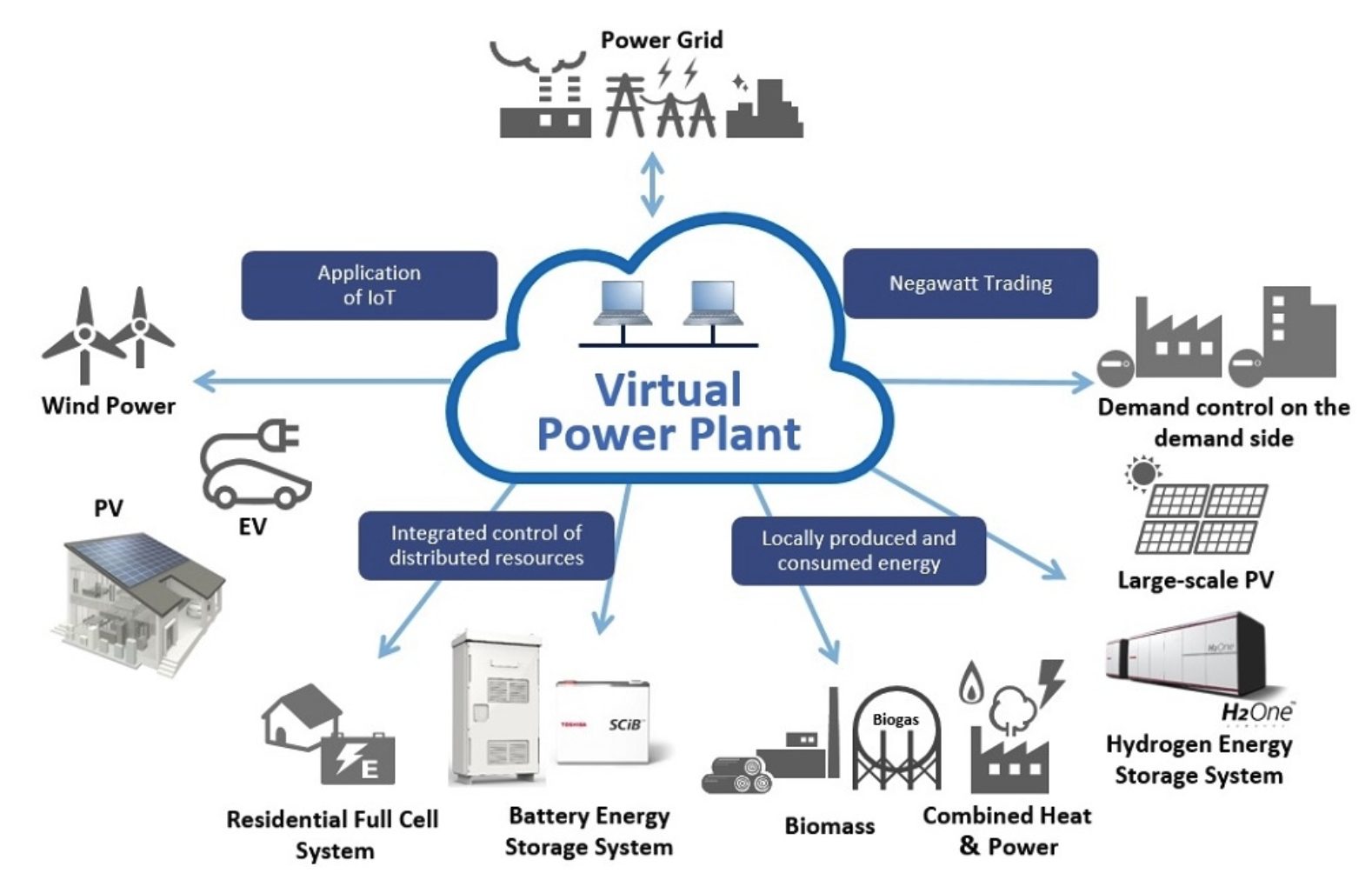

Figure 2. High-level representation of the bi-level bidding framework.

🔼 Upper Level — VPP’s Decision

The VPP chooses:

- How much energy to bid

- How to operate battery + hydrogen system

- How risk-averse to be (via CVaR parameter)

Goal:

Maximize profit while limiting downside financial risk.

🔽 Lower Level — Market Clearing

The electricity market:

- Clears demand and supply

- Determines Locational Marginal Prices (LMPs)

- Applies power flow and congestion constraints

This ensures the VPP’s bids are physically feasible.

The bi-level structure captures how market physics reacts to the VPP’s decisions.

🧩 Key Insights from the Study

1️⃣ Hydrogen Increases Profitability

| Portfolio | Revenue ($) |

|---|---|

| Solar + Wind | 3,710 |

| + Battery | 4,405 |

| + Hydrogen | 4,607 |

Hydrogen-enabled VPPs outperform battery-only systems because:

- They can shift energy across long time scales

- They can exploit price volatility better

- Fuel cells + electrolyzers provide unique flexibility

2️⃣ Bigger Hydrogen Tanks Reduce Risk

| Tank Size | Revenue Impact |

|---|---|

| 0.5× | −5.6% |

| 1× | baseline |

| 2× | +4.9% |

Larger tanks help the VPP remain profitable even under uncertain renewables and prices.

3️⃣ CVaR Controls Financial Exposure

By adjusting a single risk-aversion parameter (β), the VPP can:

- Reduce losses in bad scenarios

- Stabilize revenue

- Prevent aggressive bidding when renewable output is low

Higher β → more conservative bids → lower risk.

4️⃣ Hydrogen Performs Better Under Risk Than Batteries

Hydrogen-based VPPs are:

- More resilient to low-renewable scenarios

- Better at capturing high-price opportunities

- Less sensitive to market volatility

This makes hydrogen a future-proof energy storage option.

📘 Why This Matters

Risk-aware bidding with hydrogen enables:

✔ Higher profits

✔ Lower exposure to extreme losses

✔ More stable VPP operation under uncertainty

✔ Better use of renewable energy

✔ A path toward multi-energy market participation

As hydrogen infrastructure grows, VPPs will play a crucial role in linking electricity, hydrogen, and storage markets.

🔭 Future Extensions

The research suggests several directions:

- Real-time bidding

- Joint electricity–hydrogen scheduling

- Multi-day CVaR strategies

- Interaction with congestion forecasting

- Coordinated bidding among multiple VPPs

📘 Reference

Yoo, J., & Kim, J. “A Risk-aware Bi-level Bidding Strategy for Virtual Power Plant with Power-to-Hydrogen System.” 2025 IEEE PES General Meeting (PESGM). [link]